Login

Register

Register for free, it only takes a minute!

User Registration

Register for free, it only takes a minute!"*" indicates required fields

Register for free, it only takes a minute!

"*" indicates required fields

Protecting your art collections from physical damage and financial loss is essential. There are many things you can do to minimize the risk of damage, including storing paintings in climate-controlled environments, displaying them correctly, and insuring them against loss.

You should also create a lifetime playbook for acquisitions and dispositions, so that you can make informed decisions about adding to or selling your collection. Finally, it is important to consider the tax implications of passing your collection on to the next generation. With careful planning, you can minimize the impact of taxes and ensure that your heirs receive the full value of your collection.

Peggy M. Hollander, the founder and managing partner of The Succession Group; Laura Murphy Doyle, the National Fine Art Specialist for Chubb Insurance; and Scott Andrew Bowman, an Associate in the Personal Planning Department at Proskauer, present techniques and ideas for the preservation and protection of your art collection as well as the possible pitfalls of misguided action.

By participating in this panel discussion, you will learn about protecting your art, including:

Access 100's of art collecting videos on One Art Nation!

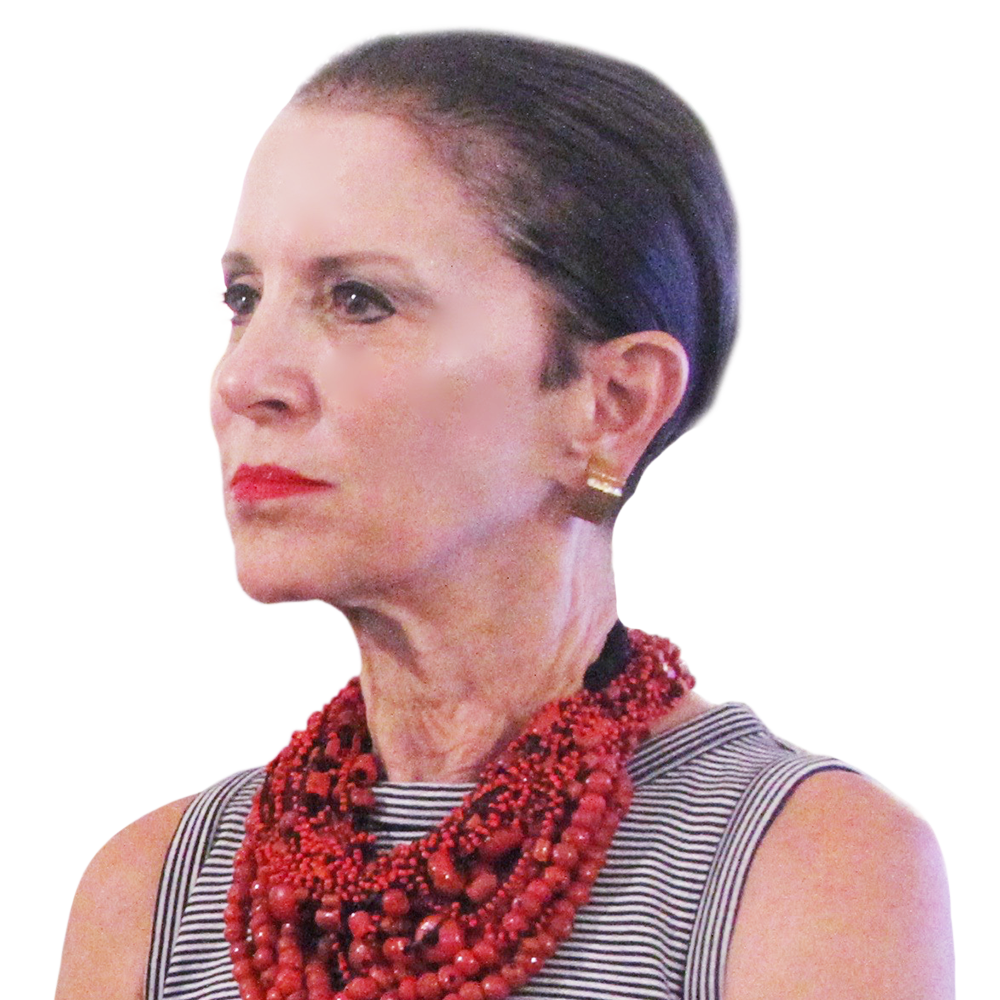

Peggy Hollander

Peggy M. Hollander is the founder and managing partner of The Succession Group. Under her leadership, The Succession Group has gained widespread recognition for its capabilities in creating innovative, customized, insurance-related wealth-transfer and multi-generational business succession plans for an exclusive roster of high-net-worth individuals, families, and affluent business owners.For...

Laura Murphy Doyle

Laura Murphy Doyle is the National Fine Art Specialist for Chubb Insurance. She attended the University of Richmond in Richmond, VA and the University of Bristol in Florence, Italy, earning a Bachelor of Arts degree in Art History with a focus on Fine Art Management. Laura has a certificate in Appraisal Studies of Fine and Decorative Arts from New York University in New York City. Prior to...

Scott Bowman

Scott Andrew Bowman is an Associate in the Personal Planning Department, practicing in the Boca Raton office. His practice focuses primarily on developing and implementing advanced estate planning techniques for high net worth individuals and their families. Scott concentrates on creating structures that provide for effective multi-generational wealth transfers, with a particular focus on...