Login

Register

Register for free, it only takes a minute!

User Registration

Register for free, it only takes a minute!"*" indicates required fields

Register for free, it only takes a minute!

"*" indicates required fields

As an art collector, you have likely spent years amassing your collection. Whether your focus is on contemporary pieces or you have a more traditional taste, your art collection is a reflection of your personal legacy. While it may be difficult to think about what will happen to your collection after you are gone, succession planning is a crucial part of responsible art collecting. In this session with Peggy Hollander of The Succession Group, she'll discuss some of the important considerations to keep in mind when crafting your succession plan.

As an art collector, it is important to have a succession plan in place. Your loved ones need to know what to do with your collection in the event of your death. Without a succession plan, your family may not be able to agree on what to do with the collection, and it could be sold off piecemeal or donated. A well-crafted succession plan can help avoid conflict and ensure that your legacy is carried out according to your wishes.

There are a few key elements that should be included in your succession plan. First, you will need to have your collection valued and inventoried so heirs will know its worth. It is also important to consider who will have control over the collection. And finally, you will need to decide what you want to happen to the collection – do you want it kept intact for future generations, or would you prefer that it be sold so that your heirs can receive a financial windfall?

It is also important to understand the tax implications of passing on your art collection. If the value of your estate is above the applicable threshold, estate taxes may apply. However, there are ways to minimize or even eliminate your tax liability through strategic planning. For example, by donating some or all of your collection to a charitable organization, you can take advantage of income tax deductions while still ensuring that your legacy lives on.

If you are an art collector without a succession plan in place, now is the time to start thinking about one. Crafting a succession plan ensures that your wishes are carried out and helps avoid conflict among loved ones after you are gone. When creating your succession plan, be sure to have your collection valued and inventoried, consider who will have control over the collection, decide what you want to happen to the collection, and understand any potential tax implications. With careful planning, you can ensure that your legacy lives on long after you are gone.

The formulation of comprehensive succession planning for art is significant, important, and challenging. This presentation will provide a roadmap for the process and give consideration to building a professional team to facilitate the planning strategies.

Peggy Hollander, the founder and managing partner of The Succession Group, will discuss:

Access 100's of art collecting videos on One Art Nation!

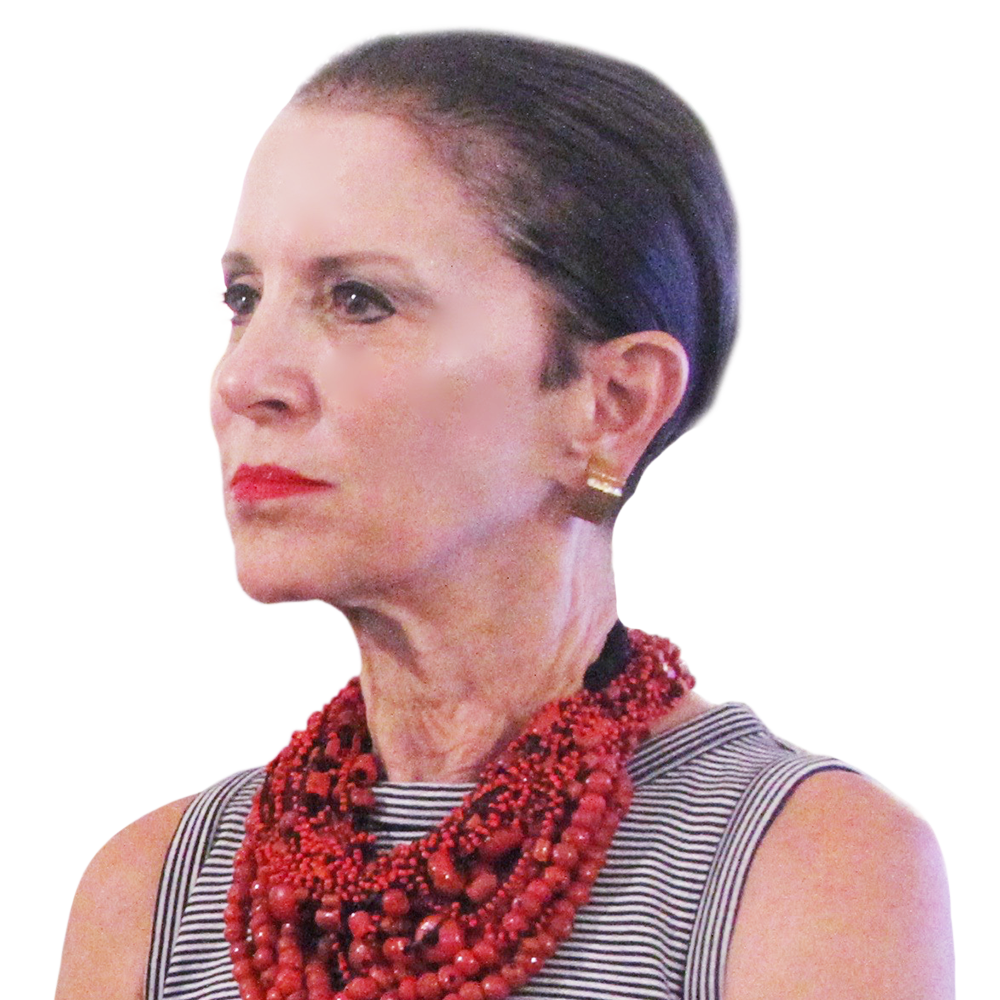

Peggy Hollander

Peggy M. Hollander is the founder and managing partner of The Succession Group. Under her leadership, The Succession Group has gained widespread recognition for its capabilities in creating innovative, customized, insurance-related wealth-transfer and multi-generational business succession plans for an exclusive roster of high-net-worth individuals, families, and affluent business owners.For...