5 Questions with Christine Bourron, Pi-eX CEO (CB)

May 28, 2020

If you don’t know of Pi-eX by now, you certainly should. Why? Well, Pi‐eX Ltd is a London based, FCA regulated, financial broker dealer, focusing on Fine Art market research and Fine Art‐based financial instruments. Christine Bourron, the Founder and CEO of Pi‐eX, took time to explain the company’s mission and discuss the current status of the art market among the corona virus pandemic.

She also recently delivered an engaging webinar for 1AN: WHAT DATA TELLS US ABOUT THE IMPACT OF COVID-19 ON THE ART MARKET, in which she examines what trade data is available in the art market and, accordingly, what’s next.

Why did you start Pi-eX and what's your mission?

I started Pi-eX in 2014 with the mission to provide all art market stakeholders, from art collectors, passionate amateurs to professional dealers and investors, with the same level of information, transparency, regulation and financial insurances they can expect when buying or investing in any other asset class.

Pi-eX Research services provide transparent information and non-biased analysis based on our proprietary database of public auction sales. The data on which we base our reports is systematically cleaned and we make sure it is not only correct but also exhaustive. Our methodology is standardized, systematic and granular, which allows for a true picture of the art market without any bias.

Pi-eX is an FCA regulated company and our clients can trust that we provide a fair and accurate view on historic and ongoing trends in the fine art market.

What do you see as the number one differentiator of the art market PRE-coronavirus and MID-coronavirus?

I think a key differentiator during and after this crisis will be the combined receptiveness and responsiveness of art stakeholders. The coronavirus pandemic is shaking the core foundations of the art market and this is not only affecting the market today, but it will also have consequences on the art market of tomorrow.

With this in mind, I think the ones who will rebound and thrive in the future are the ones who are able to understand and adapt to the new reality early enough so that they can, not only survive the challenging times, but also be in an even better position to grow when the pandemic is behind us.

On the opposite, the ones who will be most impacted by the pandemic are the ones who fail to recognize early enough that Covid-19 will have a long-lasting impact on the art market.

In light of the times, online sales are playing an increasingly important role at auction and it certainly seems that now is the time to embrace digital strategies. But is this just a trend or will it persist well into the future, after the current pandemic?

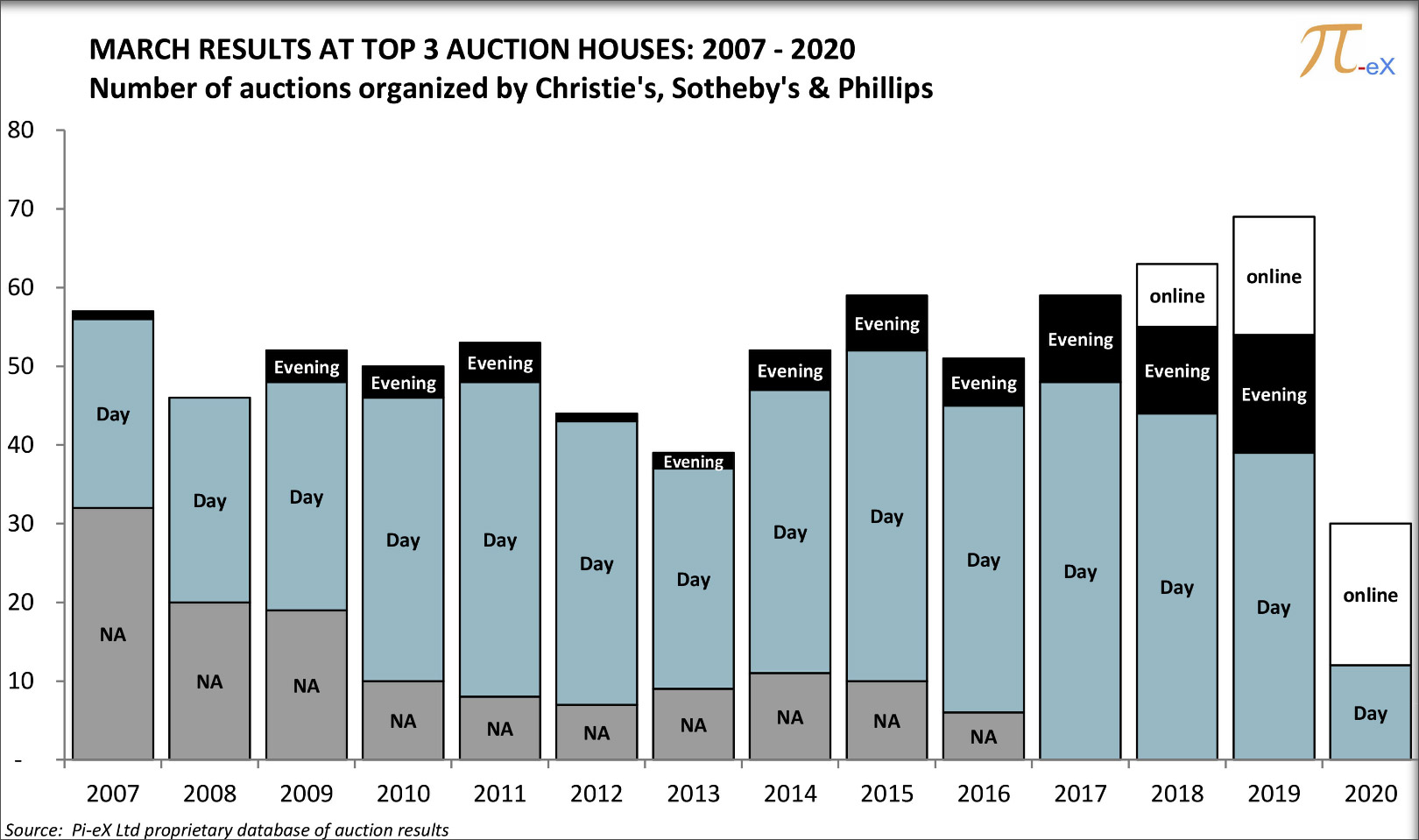

Online sales indeed are playing a critical role in the art market today. As outlined by Pi-eX research, March 2020 was the first month when online sales at Christie's, Sotheby's and Phillips represented the majority of auctions arranged by the auction houses (60%).

This was followed by online sales representing 100% of auctions arranged in April 2020. While this clearly outlines the key role online auctions are playing during this pandemic, one should not forget that the main reason for this is that auction houses are prohibited from arranging live auctions.

In the future, after the pandemic, I am convinced that auction houses will hurry up to reintroduce live sales. Surely, online sales will still be available for those who prefer to buy via their computer, but there is no doubt in my mind that the focus will switch back to live day and, especially, live evening sales.

Based on performance in the past month or two, can you imagine a world where all auctions turn to online and generate enough revenue to sustain the auction business?

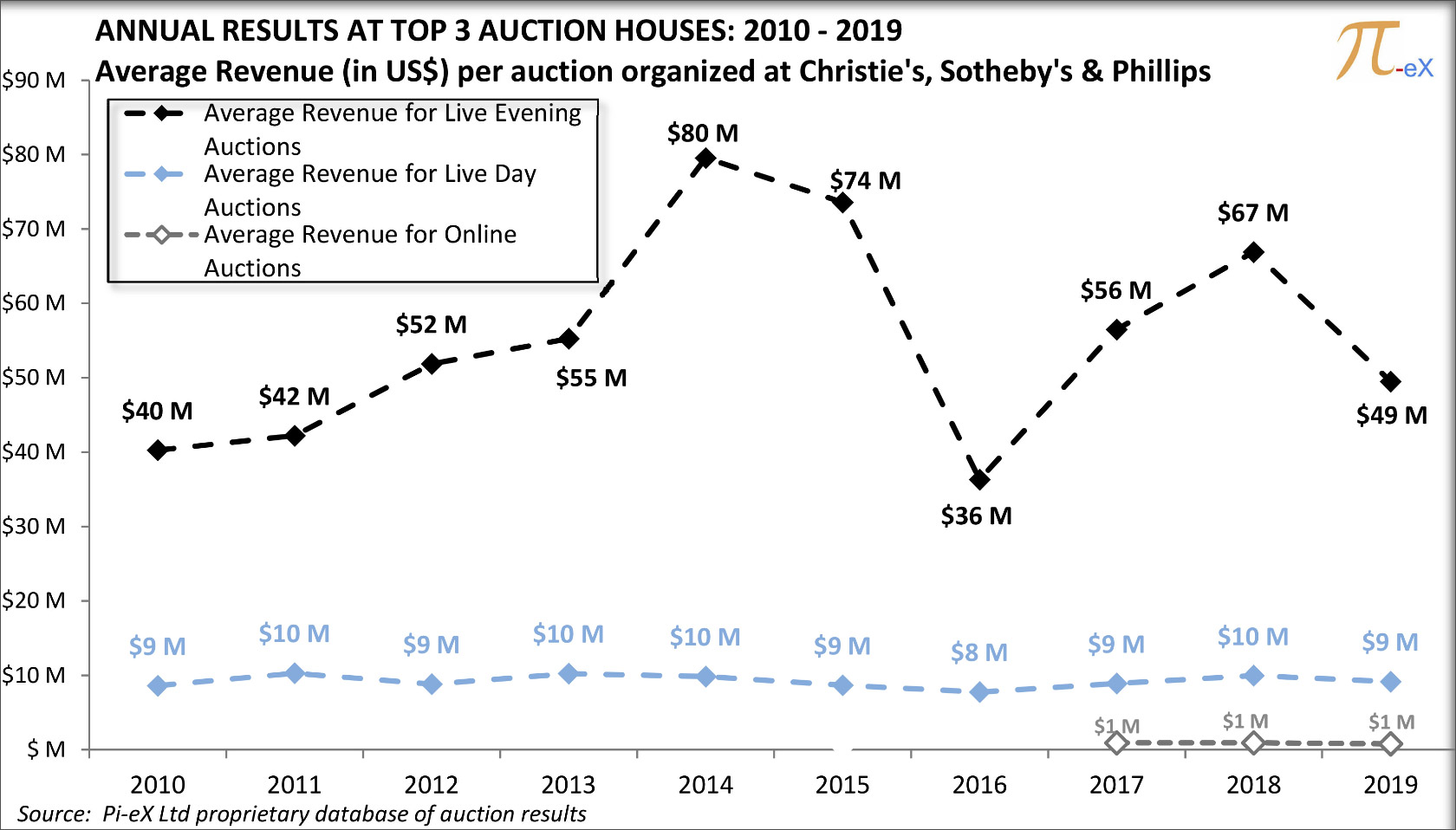

If anything, I think the past few months have confirmed so far that there is no way auction houses can rely entirely on online auctions as opposed to live auctions. Pi-eX Research already showed that online auctions were far from being able to generate as much revenue as live auctions. Our standard annual report for the year 2019 outlined that online auctions at the top three auction houses generated on average US$1 million per auction for that year. This was much less than live day auctions which generated on average over the same period about US$9 million, and this was clearly much less than live evening auctions which generated on average US$49 million.

At the beginning of May, Sotheby’s CEO reported that Sotheby's had held 37 online auctions totaling nearly US$70m. This means that Sotheby's online auctions brought in on average US$1.9m per auction. This is almost double the average revenue generated by online auctions at the top 3 auction houses over the past 3 years as shown above. While this is an impressive result in this time of crisis, it certainly shows that online auctions are still far from being able to replace Live auctions.

Any predictions for the market POST-coronavirus?

During the coronavirus pandemic and in its aftermath, I think the art market will suffer from an accentuated liquidity issue. In other words, I think it is going to be quite challenging for sellers to obtain the prices they want for their artworks.

The art market is already not the most liquid market as opportunities to sell, especially high-end art, only come through at particular times and particular places. A few of these have already been missed as live auctions around the world were cancelled due to the pandemic. This was the case for example with key sales as the Paris March Impressionist sales, the Spring Hong Kong sales or the New York May evening sales.

Some of these sales will be held at a later time, but one can wonder how much art the market can take if all these sales happen within a short period of time.

As we enter these times of uncertainty, I think we will see some works offered at lower estimates at auctions as well as more works sold through private sales. In such unchartered territory, I believe that ongoing reliable information on the state of the art market will play a crucial role in aligning expectations between buyers and sellers.

Watch as Pi-eX analyses historical auction sales trends to understand the impact Covid-19 is having on the art market as of end of March 2020. Watch now and read more about Pi-eX here.

:sharpen(level=0):output(format=jpeg)/wp-content/uploads/2021/11/5-Questions-with-Christine-Bourron-Pi-eX-CEO.jpg)

:sharpen(level=1):output(format=jpeg)/wp-content/uploads/2024/05/The-Art-Lawyers-Diary-1.jpg)

:sharpen(level=1):output(format=jpeg)/wp-content/uploads/2024/04/5-Questions-with-Bianca-Cutait-part-2-1.jpg)

:sharpen(level=1):output(format=jpeg)/wp-content/uploads/2024/05/20231208_164023-scaled-e1714747141683.jpg)

:sharpen(level=1):output(format=jpeg)/wp-content/uploads/2024/04/header.jpg)

:sharpen(level=1):output(format=jpeg)/wp-content/uploads/2024/04/5-Questions-with-Bianca-Cutait-part-1-1.jpg)

:sharpen(level=1):output(format=jpeg)/wp-content/uploads/2024/03/5-Questions-with-Alaina-Simone-1.jpg)